Making Tax Digital VAT

What does Making Tax Digital VAT mean to me

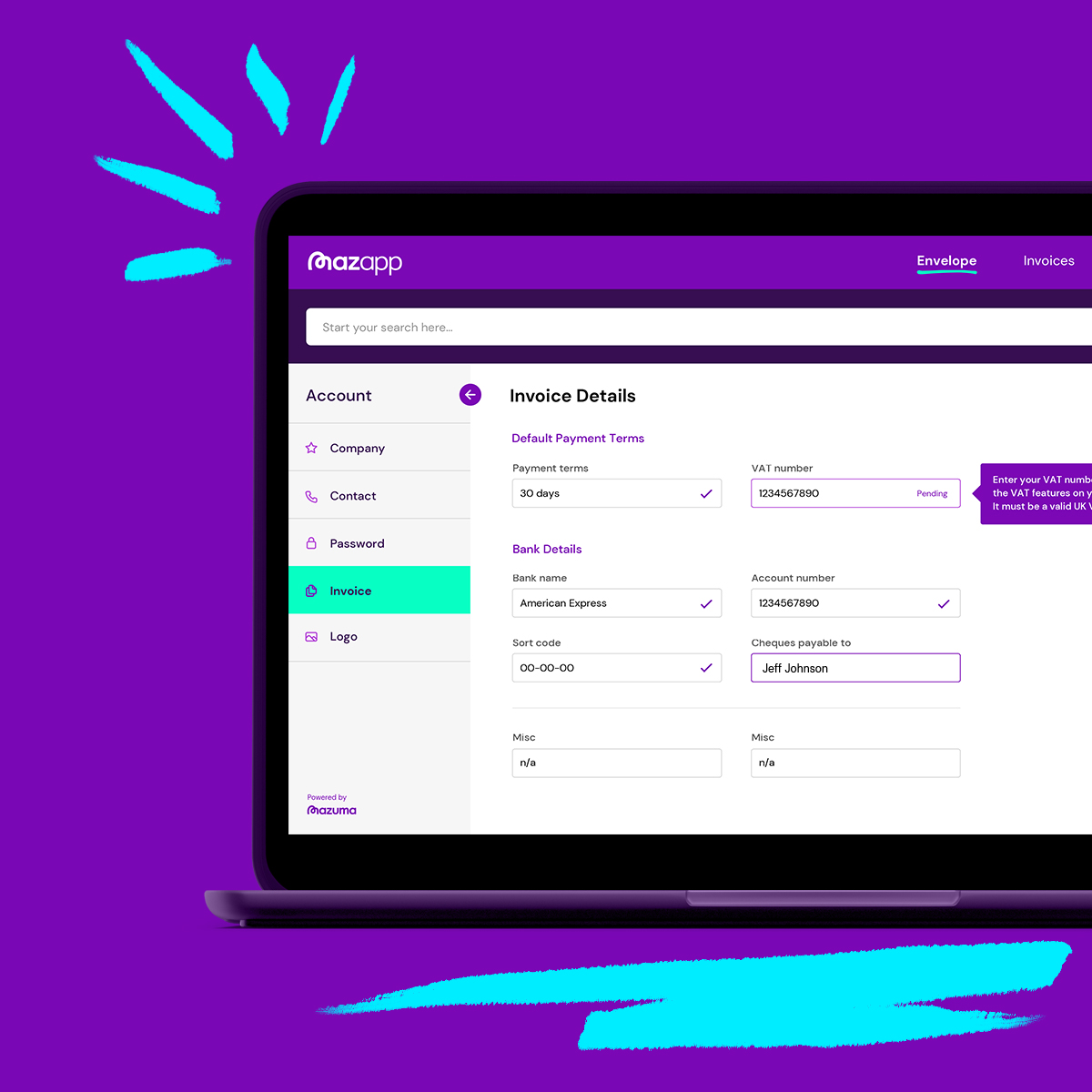

VAT Returns must be filed through HMRC-approved software

VAT-registered businesses with a turnover above the VAT threshold (currently £85,000) must submit their VAT Return using compatible and approved software. There is a list of approved software suppliers on the HMRC website. This means that it’s no longer possible to submit VAT Returns directly via HMRC’s website as you’ve been able to do for years. Don’t panic though! Your accountant can still submit the VAT Return on your behalf or you can choose a piece of HMRC-approved software to use.

Businesses must now keep digital records. Most VAT accounting records relating to the VAT Return must be kept digitally and/or using software for the statutory legal period of six years (10 years for mini one-stop shop (MOSS) businesses).

MTD for VAT applies to almost all of the VAT-registered businesses in the UK

It isn’t possible to swerve it or opt out apart from in very specific and rare circumstances.

And it’s here to stay. In July 2020 HMRC announced their new roadmap which tells us the dates by which everyone must file in line with MTD:

VAT-registered businesses with a taxable turnover below £85,000 will be required to follow Making Tax digital rules for their first return starting on or after April 2022.

Self-employed businesses and landlords with annual business or property income above £10,000 will need to follow the rules for MTD for Income Tax from their next accounting period starting on or after 6 April 2023.

It’s not all doom and gloom, though.

What is HMRC’s plan with Making Tax Digital VAT?

HMRC has said that it won’t widen the scope of Making Tax Digital for business beyond VAT-registered businesses before the system has been shown to work successfully. In an announcement in July 2020, they have said that it won’t be until 2023 that almost everyone will be required to file in line with MTD.

This time frame will ensure that there is time to test the system fully and for digital record keeping to become more widespread.

What will businesses need to do for Making Tax Digital when the scope widens?

There are three main changes which MTD may bring to how your business does its taxes.

Digital record keeping

The first main requirement for businesses for MTD is to maintain records digitally using third party software. This is something you may already do, so may not actually have much of an impact on how you currently keep track of your records. For those not already keeping digital records, it would be wise to start that process now and become comfortable with it before it becomes mandatory.

Quarterly updates and a tax estimate in year

Business owners will need to update HMRC on a quarterly basis using their digital records – a significant shift in current obligations. Many businesses already keep on top of their record keeping and accounts in order to keep themselves accountable and keep track of their finances. However, if you don’t already provide regular updates, it may be an extra burden on your shoulders. Despite the extra hassle, it will give greater certainty about your tax liability throughout the year.

Paying more frequently

Although it hasn’t been confirmed by HMRC or government, MTD could give businesses the opportunity to pay tax more frequently, closer to real-time and potentially on a voluntary basis. This is different to how businesses currently pay their tax bill – once per year after the end of its financial year. Given that it was introduced with Real Time Information in payroll back in 2013, it’s our prediction that it will also be introduced as part of MTD.